Yes, go on, let NVIDIA buy intel. Let them buy AMD too. What could go wrong. I love monopolies! /s

Oh but surely the second such an all-powerful monopoly appears, someone will start a competing company in their garage and go on to restore equilibrium /s

This is all so normal and sustainable.

Which means they're in a bubble because Nvidia's total assets (85B$) value is less than half of Intel's (205B$). I refuse to believe that the "potential for growth" of Nvidia is worth anywhere close to 120B$ in actual value even in the next 5 years. I see only two things here: either Intel is undervalued, or Nvidia is overvalued. I think it's both. When that bubble bursts it's going to hit very hard for a lot of people because it's the same thing as the other big tech companies (apple google meta etc) are all valued based on predictions and magic when the companies that have an actual intrinsic value are worth less

Intel is lagging behind AMD and NVidia with no sign of catching up. Meanwhile NVIDIA has a monopoly on AI.

It's no wonder NVIDIA is worth far more now.

Intel have shown signs of catching up by putting out a better iGPU than AMD's latest and greatest for laptop chips in certain games and most compute tasks. They've also put out one of the best laptop chips last month, they consume next to nothing while still having decent performance but go on I guess

Aren't the best handhelds using AMD iGPU's? The MSI Claw didn't exactly leave a great mark. The new Radeon 890m looks pretty killer for its power efficiency.

The cpus I'm talking about have released about a month ago, but until very recently AMD were the only good options for handhelds

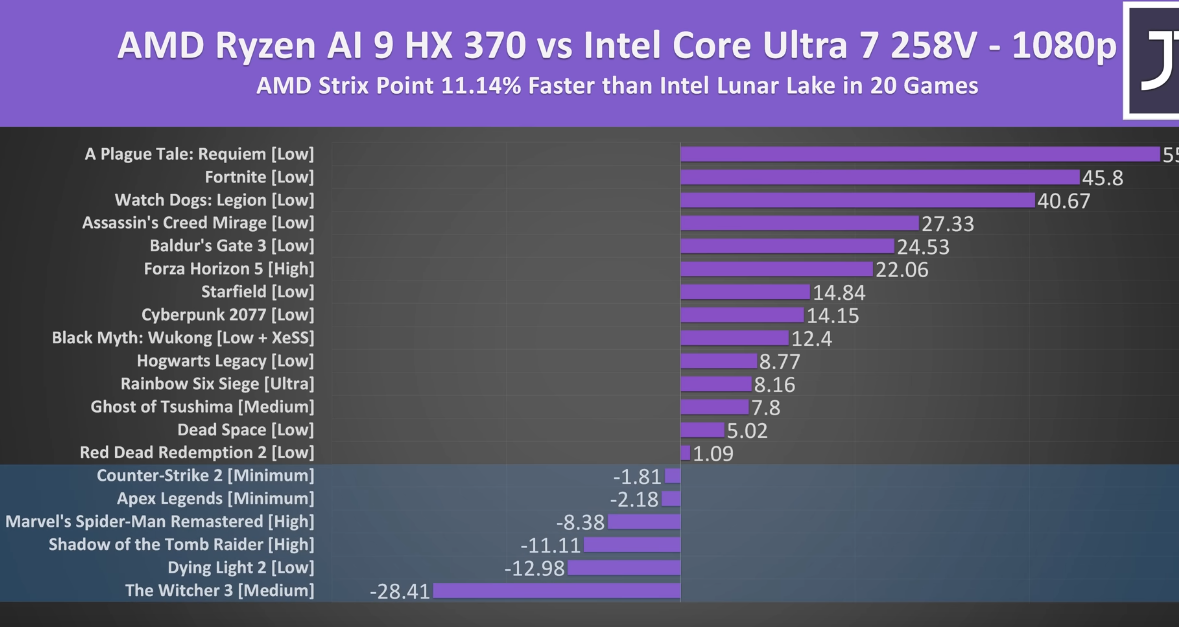

Just checked the new release, you're right it's looking pretty good. The AMD variant is still ~11% ahead in many games but it's certainly much much closer than before. https://www.youtube.com/watch?v=IZkSoXPNBpA

This is mostly down to the drivers, and I am sure they will be much improved in the next few months, their driver is still very young and hopefully has lots of room for further improvement

Being best in one aspect of the laptop market is not going to save Intel. They are losing their grip on the server market. That's where the real money is, and once those customers go AMD, they are likely to stay there for the foreseeable future.

Intel has made some major strategic errors and may not be able to bounce back. At least, they won't bounce back with the company looking the same as it did. Their fabs need to be spun off to an independent subsidiary--which is apparently already underway--which will eventually be spun off entirely like AMD did with Global Foundries. The remaining company focuses on engineering. The resulting company won't have the same assets, but could potentially get them back to doing good work.

AMD's chiplet design has proven to be the way to go, and Intel has been struggling to replicate it across their entire lineup. I can get into the details of how genius it is, but suffice it to say that it lets AMD be extremely responsive to changes in the market in ways that were never possible before.

So is Intel undervalued? I don't think so. The market has decided their problems are so negative that it drags down the company below what their direct assets are actually worth, and the market is probably right. However, this is not a death sentence, and there are ways that the company can go on.

Is that why AMD is able to bring out those new amd4 chips for gaming even though they'd moved onto am5?

Or was that just amd having some am4 capacity left?

A little of both. The node that those am4 chips are running on is cheap, so why not?

If this is all Nvidia stock let him try to cash out and see what happens.

The thing that bothers me when people say "oh its unrealized gains, it's not real money" is that they use those unrealized gains as collateral for loans of real money. They effectively ARE that rich.

It's BS that you can borrow against it. If he did sell it the valuation would drop.

As far as I'm concerned, that's the point at which unrealized gains should be taxed: as soon as you're using it as leverage

Banks don't take this into consideration when assessing collateral?

Lol, who downvotes a question?

There are completely different rules when you are that rich. Look at Trump, he bankrupted how many businesses and banks STILL lined up to loan him money. At the very top, your trading favors and power.

Take what into account? They basically look at current valuations and offer loans up to some fraction of that amount.

And that's generally the way the ultra-rich operate, they don't actually sell anything, they just borrow against their assets. They punt the can down the road until they die, at which point those unrealized gains get stepped up in basis for those who inherit it. If you have enough stock assets, you can service the debt with the capital gains you're forced to realize (i.e. dividends).

So the bank sees someone with $100B in assets asking for a $10M loan or whatever, and they're completely happy to offer that, because even if the stock gets cut in half, he can still pay the debt.

You dont need to sell your stocks to access that wealth. You can use that as collateral to take loans or exchange stocks.

"unrealized gains" that you can somehow live off of indefinitely.

Elons everything comes from having overpriced tesla stock as collateral

In case anyone was curious - the avg daily turnover of nvda is 300 to 350 million moneys.

I'm so excited for the AI crash

Crazy how quickly NVIDIA went up. I wonder if they'll crash down just as fast should the AI hype either die off or shift to other manufacturers (Intel, AMD etc.) or in-house solutions (ex. Apple Intelligence).

I just want to get a graphics card for less than the rest of a rig combined... shits ridiculous, and AMD doesn't seem to be even trying to compete anymore

they do compete, its just users weigh DLSS and Raytracing far more than they should, and devalue VRam in long term situations

for example a 7900 GRE cost about the same as a 4070, but more people will buy the 4070 regardless

I definitely do like raytracing, sadly. I'm more interested in graphics and immersion in a setting/story in a game than competitiveness or ultra-high FPS. Water reflections and mirrors just look absolutely gorgeous to me.

I'm definitely strongly considering AMD regardless for my next build, as I'd like to switch to Linux fully at some point.

Eh, I got an AMD GPU somewhat recently and it meets all my expectations. I'm not too interested in RTX or compute, and they have a really good value on raster performance.

I'm coping for RDNA4.

Apple is not there yet, its models were trained on Google hardware. Though I am surprised it wasn't Nvidia hardware.

What's "Google hardware"? Likely just NVIDIA hardware running in Google's cloud?

No no, Google does actually have its own custom proprietary AI hardware - https://en.wikipedia.org/wiki/Tensor_processing_unit

Ah, TIL.

Fuck you, Huang.

No, he's not. It's only his inflated market value.

He can turn a significant chunk of this value into actual dollars, even without selling the stock. This line of reasoning that execs' worth is not what it seems to be because it's based on share value is constantly used to discount their wealth and argue against acting on wealth inequality.

Exactly. At the very least, he could go get a margin loan at relatively low cost (like 5%) compared to the tax burden of cashing out (20% or more). And that's just using publicly available numbers, a billionaire can get a lot cheaper loans than that.

Both numbers are based off market value, though

Nobodies care but okay...

(Not talking about your post, but the money of Huang)

It would be an epic double-down if he spent his entire personal fortune to acquire Intel, taking on a large amount of stock ownership in the combined company. As if he had so much confidence in the future that he was willing to bet everything on “we’re just getting started here.”

Technology

This is a most excellent place for technology news and articles.

Our Rules

- Follow the lemmy.world rules.

- Only tech related news or articles.

- Be excellent to each other!

- Mod approved content bots can post up to 10 articles per day.

- Threads asking for personal tech support may be deleted.

- Politics threads may be removed.

- No memes allowed as posts, OK to post as comments.

- Only approved bots from the list below, this includes using AI responses and summaries. To ask if your bot can be added please contact a mod.

- Check for duplicates before posting, duplicates may be removed

- Accounts 7 days and younger will have their posts automatically removed.