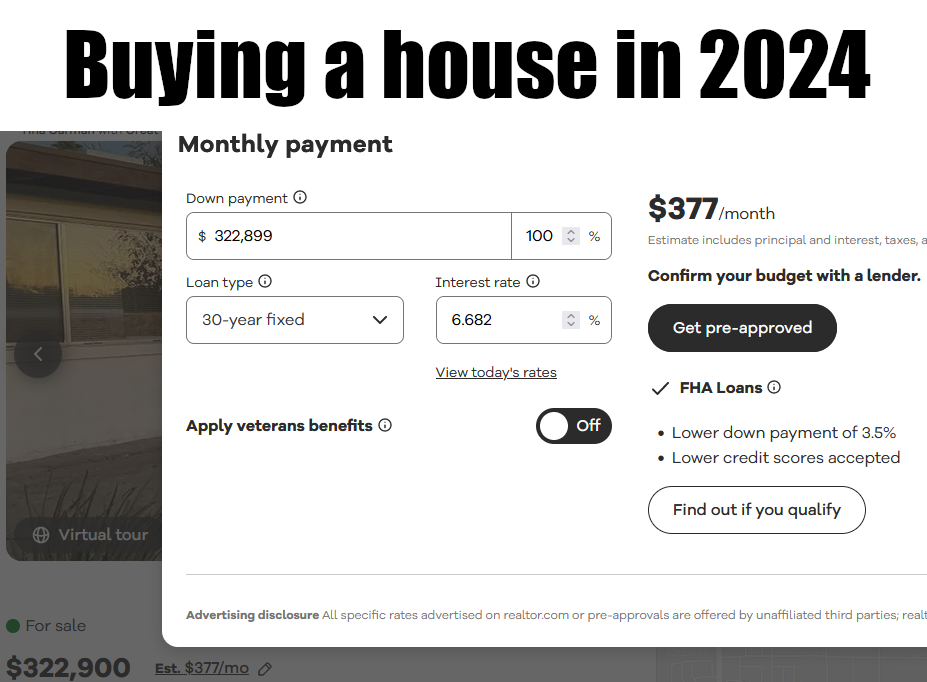

Calm down, this isn't the banks screwing the little guy. This number includes tax and possibly insurance

"PITI" (principal, interest, taxes and insurance) is the standard quoted cost. It's just an estimate. You can often pick your own insurance which will change the cost, and if you're buying in cash, insurance may not even be required. (It will almost certainly be required if you have a loan, since the bank wants its assets protected.)