This is the biggest reason I haven’t moved. I managed to buy a house in a low cost of living area, with a low interest rate. Any move would force me to throw away my money renting, take a massive size/quality hit, or become house poor. And like them, I make about $250k.

I think your situation is a bit different. They are choosing not to relocate to a place where they can buy, because they tried that and thought it was boring. I am certainly not saying the housing market is fine, but these folks made a decision between buying a house and living in their preferred locale.

Personally, my family made the opposite choice two years ago, leaving the Best Coast and moving to the Midwest in large part so we could afford a house, which we did on less than $250k/yr gross. This locale is not our first choice, but our priorities were different from the priorities of the couple in the story. Money was not their only issue.

But fuck the housing crisis. We need policy changes that highly favor primary place of residence and disincentivize rental properties.

I was shocked to find out that over 50% of millennials own their own homes.

I'd venture to say a big chunk of those folks inherited wealth. Most millennial homeowners I know inherited money from grandparents, aunts, uncles, and/or parents.

And like many who inherited wealth, these folks often make up their own little rags to riches story about how they got where they're at.

Roughly 3% of Millennials have inherited money according to the findings in Northwestern Mutual's 2024 Planning & Progress Study.

Misleading statistic. This doesn't include parents/grandparents who buy houses and then put their kids name on the title. Nor does it include when parents pay for all their kids college expenses, or rent, or their cars... etc...

Yeah, my wife and I didn't inherit any money or get any kind of gift for a down payment but we wouldn't be homeowners unless our parents paid tens of thousands into each of our college educations.

I'm a millenial but not one of those people you're describing, and I have actually paid my condo off.

The keys for me:

- No kids

- I job hopped in (what at least used to be) a high-paying field (tech)

- I moved job markets from a low COL (cost of living) market to a high COL market

- No student loan debt for me (my mommy and daddy paid for my tuition to a local state school 🫶 ), minimal student loan debt from my wife (~5k)...which I paid off after we got married

- I don't give a shit about cars...I drove used cars until I could comfortably buy a new one cash

- We only have one car between the two of us

- I moved rather than paying higher rents, and I often lived in really crappy apartments because they were cheaper (I do not recommend btb)

Healthy helping of luck involved, and definitely support from my parents by way of room and board until I was like 23, tuition, small car loan of ~8k after I graduated. However, I paid them back in full for the car, and I'm the only one of my siblings not to hit up Mommy and Daddy regularly like an ATM. I fucking hate debt with a passion (or even really temporarily owing someone else anything) and have basically never carried large amounts of it outside of when I had my mortgage for my condo.

(My neuroticism around debt is probably why I paid off a historically low rate mortgage...if I would've sunk that into the stock market or something instead of paying it off I probably would've made a fortune.)

Yeah.... Maybe this is one of the ways I should start associating myself with Gen Z but they also have higher home ownership than boomers did at this age cause apparently the covid fire sale left them still with their parents money and cheap houses.

I dunno I really don't know how anyone does it but I have also been homeless 3 times since I started college so not really a great example.

I'm not sure I understand the math in this article. At current interest rates, a $550000 is closer to a 3.5k mortgage, not 5k.

At 250k a year, they're making roughly 20k per month. If they're willing to pay 30% of their income to a mortgage, that's 6k. Even post-tax, that's still more than 3.5k.

I agree that the cost of housing is ridiculous. This sounds more like they have exceptionally bad credit or they're looking at homes that are way above their budget.

So it sounds like they had a house in a reasonable area...

Her old boss called her up in 2021 offering double what she got paid last time...

And they never thought to check why she was being offered twice her salary to do the same job?

It's likely because everyone moved away due to housing prices if they weren't insanely wealthy. Shouldn't have sold the home they owned before they even googled the price of homes where they were moving.

Also makes me think it's likely they have exceptionally bad credit like you said. They got two kids, and apparently do zero planning for huge life decisions and complain when shit doesn't work out. Other families raise kids on legit 1/10th of the money this family has...

And she's a financial specialist?

They could spend 70% of their income on their housing and still have more leftover than I make in a year.

As someone who will have to dedicate 60-70% of their income to own a small, run down home, i really dont have a lot of sympathy for them. 30% of your income to housing is considered affordable, however that metric has likely been impossible for most people to reach over the past decade, most people can't even rent for 30% of their income these days.

Im not supporting high housing and rent costs, i just think compared to average American right now, this couple shouldn't really be considered "struggling" or "poor"

As someone living in Germany, what pissed me off most was when they mentioned that they never imagined raising their kids in an apartment. Like an apartment is beneath them. It is 2024. Don't we all know that heating single family homes and the sheer extra space they require is absolutely disproportionate? Everyone wants a cheap huge single family house in the middle of the city and no cars and no climate change. Like, yeah, that won't happen. Can we please start normalizing living in apartments? We just moved to a much cheaper city and hope to buy a 3-4 room apartment here one day. This will still cost us about 600k and we make less than 50k combined. But even if we had the money to pay over 1.5 mil for a house here, I wouldn't want to live in a house, unless I'd have like 6 kids.

As your kids age into teens and young adults, the apartment offers more freedoms than suburbia as they wont require a car to go anywhere. In many US suburbs, kids are chained to their parents as a taxi service until they need to buy their own car. Which is why so many american suburbs have 4+ car sized driveways, because every human in the house must buy a car and gas and insurance etc.

Don't worry, there are plenty of suburban apartments to get the worst of both worlds these days

Where i live, a decent 1500SF is easily $1M+. Renovated? Probably $1.2M.

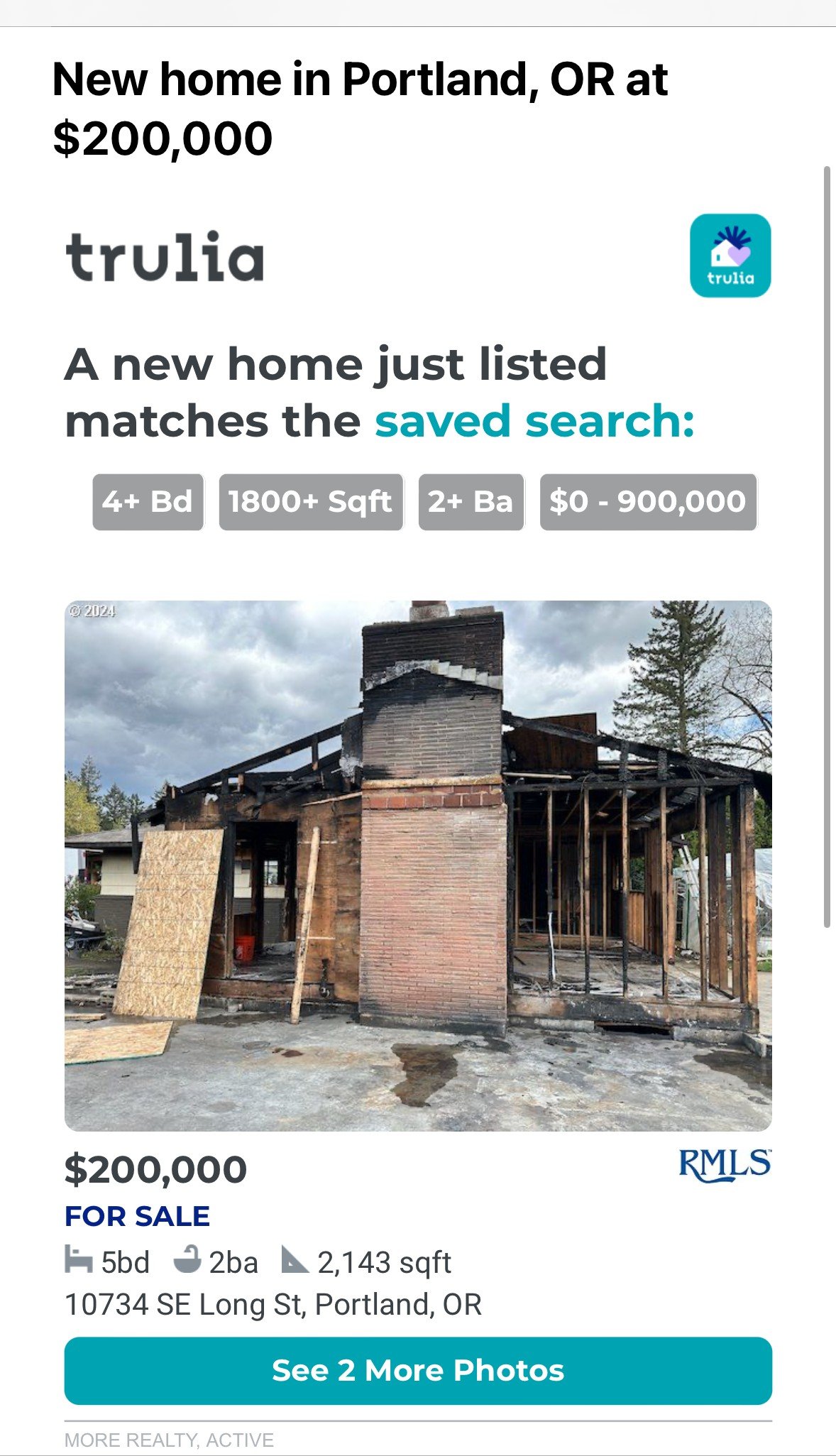

I've been house browsing in the Portland area for a couple years and am losing hope of ever being able to afford one. Last year I saw a frame of a house, basically a roof on studs with tarp and plywood as the "walls" being listed for sale. They were asking for $300k.

Seems cheap for land. You must be in a low cost area. I’m reading your post as $300k for a buildable lot in a major city.

Last time I renewed my homeowners insurance, they put full replacement value of my house under $200k, despite the tiny plot of land and overall purchase price being several times that. I wish my town outside Boston had a buildable lot for only $300k, but the reality is much worse and the house itself is only a fraction of the value

It all seems beyond insane to me considering that records show houses in my modest, outer-city neighborhood were selling for around $50k in the early 2000s that now have a market value of over $800k.

As someone who lives here:

This is real.

It has the audacity to include that listing as "a new home".

If you own a vehicle maybe venture out of the city a little ways. Bonus points if there is any type of public transportation to take you to the city.

No, I've lived in suburbs for much of my adult life and I have no interest in that lifestyle. Much like the family in the article, I make enough to rent in the city. But it sucks knowing that living where I want to be comes at the cost of spending the money I could be using to invest in my community and improve the home I'm living in instead to line the pockets of somebody who was either lucky enough to own the land before property hyperinflation or wealthy enough to purchase it after the fact.

These stories are always bullshit. They can't afford a 3000sqft single family home on an acre inside the beltway of a HCOL city. Anyone making $250k can easily afford a condo or townhome anywhere in the US. If you really need useless interior volume or wasteful yard space then you can move farther out and afford that.

Wasteful yard space? Do you enjoy playing Frisbee buddy? How about just running around with your kids.

What is a public park?

In a lot of neighborhoods in the US, you have to cross major, high-traffic streets to get to a fairly small public park.

Then that is less of a city and more dystopian urban sprawl pretending to be a city.

That pretty accurately describes pretty much every U.S. city that isn't directly on the East Coast, yeah. And even a few that are.

Out of curiosity I checked how much a 3000 sq ft home on 1 acre lot is in my area. The only thing under $4m was a $2.4m fixer-upper.

It's high time we get over this notion that in America, you rent for a couple years, save money, and then buy a house. It is simply not possible anymore. The only people buying houses are people that have a house to sell.

We are lifetime renters and we live in a community with lifetime renters. Some of us even have GASP kids in an apartment.

Which is especially fucked up considering how large the US / Canada is and how much space there is.

Politicans are artificially keeping supply low which fucks all the young people, but appeases the Boomers.

I totally get how they feel.

I got lucky with some investments I made in 2020 that appreciated post-covid and was able to pay off my student loans and put a down-payment on a condo.

If you're a wage earner, at least here in the US, the prevailing political thought seems to be that it's perfectly acceptable for you to live on gruel in your grossly expensive rented apartment. I wish I could hope that voting changed anything about that, but I don't think it matters who we elect anymore, at least beyond the local level.

Seriously.

I realize, daily, that I've very much lucked my way into my station in life. Two kids, a 4bed/1.5 bath house in the suburbs. Decent steady job. 200k household gross income.

My house is "worth" a half a million dollars. At least. But so is any other house that is maybe a sidestep. There is no moving to another town...we can't manage to accumulate any significant savings before something happens to take it all away. Even if we could swing the cash necessary to start buying a house, we were able to refi during the pandemic....so moving to a similar-priced house now will mean a significantly higher mortgage due to the higher interest.

Over the past three years, the couple, who are both 36 and live in a suburb of Portland, Oregon, have been looking for a home.

Yeah, it be like that here. Most houses are costing around 1,000,000 in the Portland area due to wealthy techbros moving from San Fran.

Renting for life, this is exactly what the landowning class, much of whom are now giant hedge funds that have been soaking up houses and properties for cash on the barrel head, in this country want.

We desperately need national legislation to put an end to people and corporations owning large swaths of homes in this country otherwise we will end up with fiefdoms and are in danger of returning to a world of medieval nobility in land ownership.

didn't they get the memo: houses are for the 1% now. 250K might sound like ~~a lot~~ enough, but you're still a peasant to the people who own you

You raise a great point.

To the Owning Class, those working for money are nothing and replaceable. Rise up with the poor.

As I mentioned elsewhere, over half of millennials own their own home. So it's more like houses are for the 53%, but I take your point.

Bringing in 17k+ per month after tax and cannot afford a home?? I call bullshit. A $750k home is 5k per month including HOA/tax/insurance. That’s less than 30% of their take home.

They could double their payment and pay it off in 5 years, with 7k per month to live on, then they live rent free for the rest of their lives.

This article feels like propaganda. Homes are over priced but 250k per year is a lot of money.

They want to keep their monthly mortgage payment between $3,000 and $3,500 — or around 30% of their monthly take-home income of about $11,000.

This makes it seem like they only take home a little more than half their wages.

Something doesn't add up. The only issue I see is one might be an independent contractor. Or they're excluding health insurance and 401k.

Edit: some quick digging. First issue is the definition of take home pay.

Take-home pay is the net amount of income received after the deduction of taxes, benefits, and voluntary contributions from a paycheck. It is the difference resulting from the subtraction of all deductions from gross income. Deductions include federal, state and local income tax, Social Security and Medicare contributions, retirement account contributions, and medical, dental and other insurance premiums. The net amount or take-home pay is what the employee receives.

But the bigger issue is the 30% rule. 30% is on gross and not take home. This would give them a out 7k per month. I bet they're following the advice of someone like a Dave Ramsey. These people are not victims.

I guess I'm lucky that I don't get bored easily because I can afford a house quite easily since I don't have to live somewhere "fun."

With "fun" do you mean places where there are jobs?

Or maybe where their friends and family live? Where their kids have friends and support groups? Maybe where they've lived much of their life and don't want to leave?

The previous poster is just making shit up so they can cast shade. It's sad, really.

A Boring Dystopia

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world