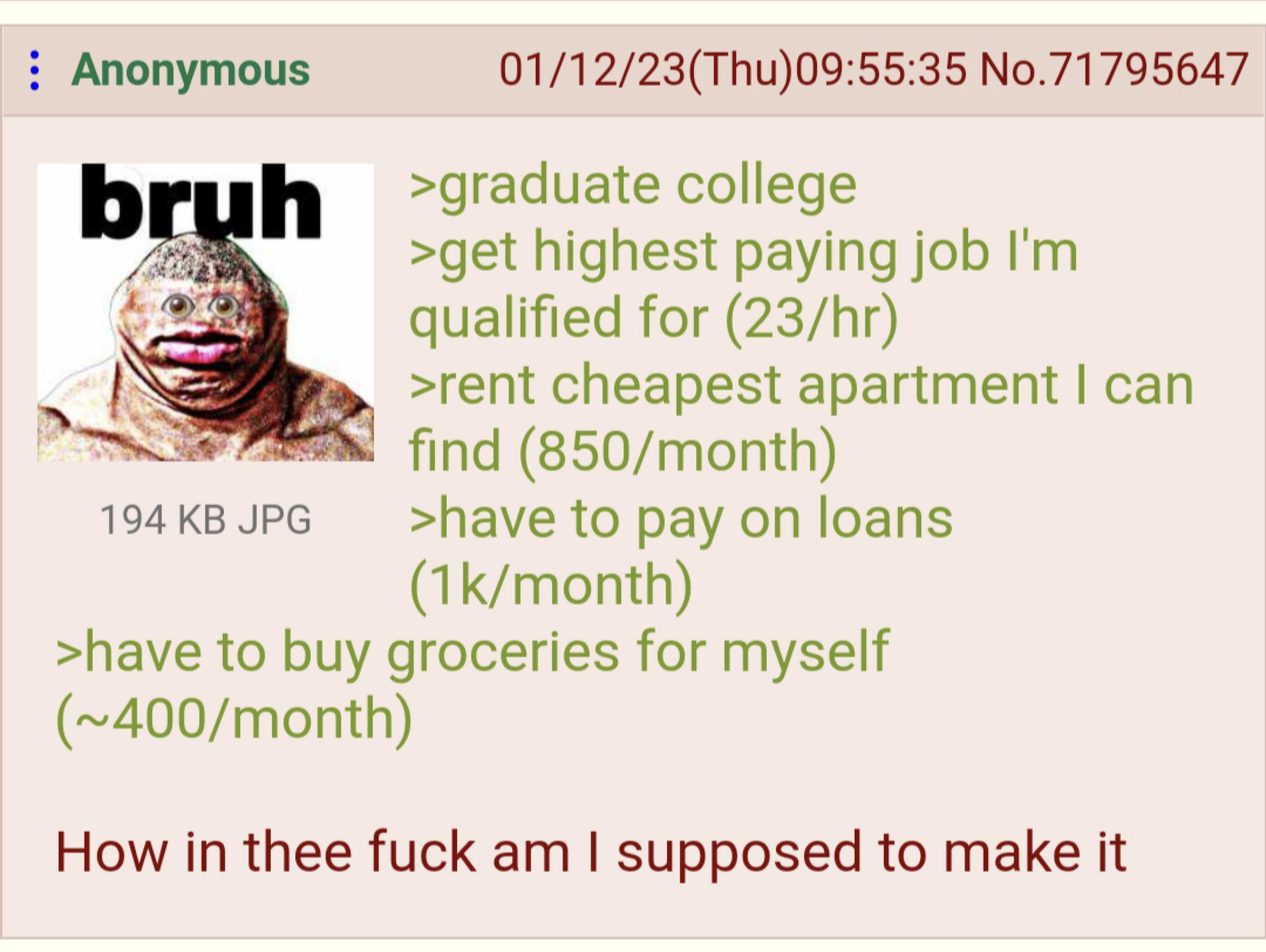

If we take out 7k of the gross $46,0000/yr for healthcare and retirement....

$5,700 for federal taxes, another k for state taxes...

That's about $2692 a month, net. Subtract the just over $2k a month listed, there's another $400 a month for.... Utilities, phone, transportation, entertainment, savings, emergencies.

Even as rent is under 25% of income, pretty tight. Doable. But very tighter. You will never retire saving $4000 a year. You can never get sick. You apparently walk to work.

Pretty much have to get a roommate until the student loans are paid off.