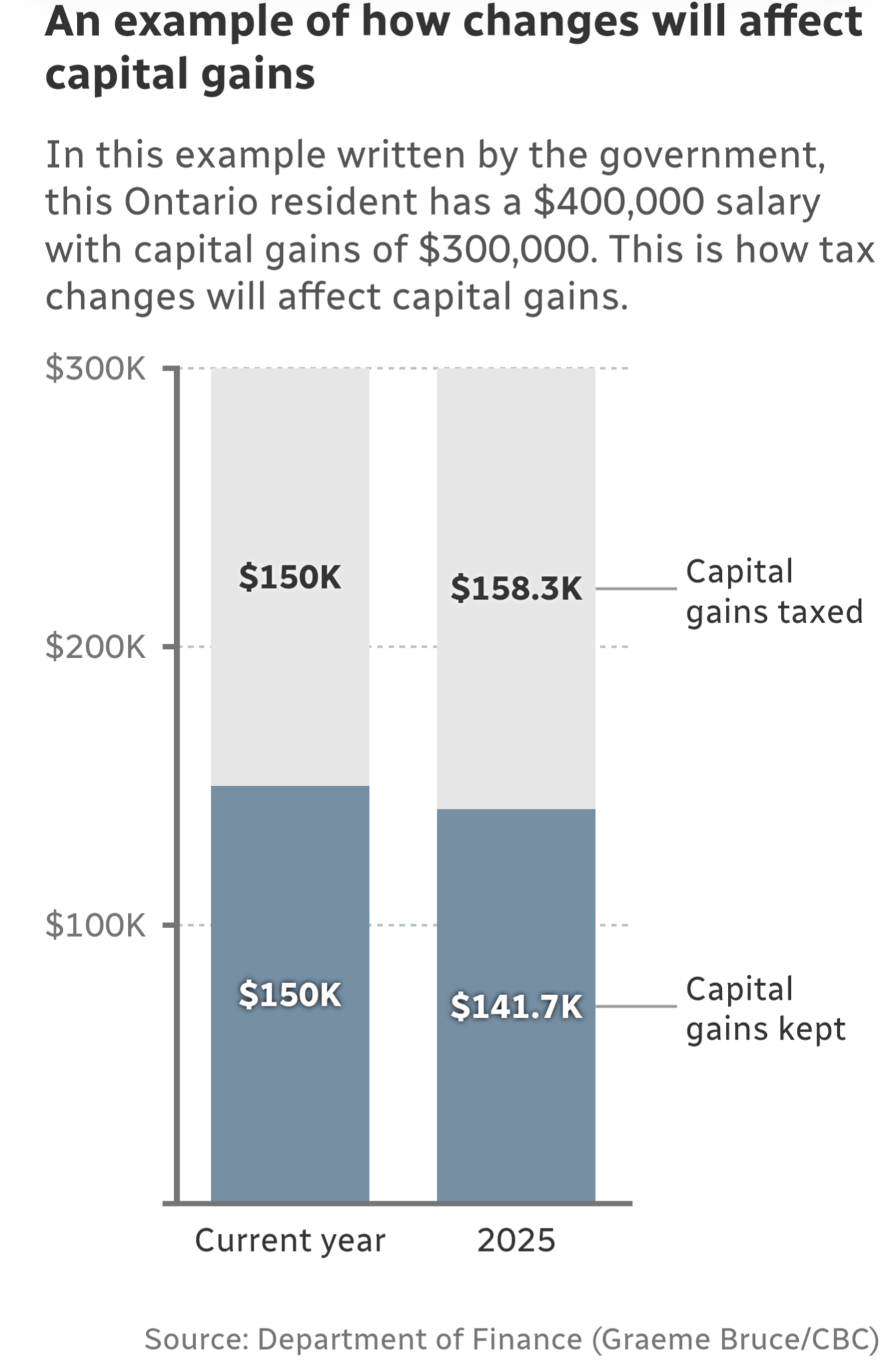

While not exactly the wealth tax or excess profit tax some had suspected, Freeland is targeting the wealthiest 0.13 per cent by increasing the capital gains inclusion rate — the portion of capital gains on which tax is paid – for individuals with more than $250,000 in capital gains in a year.

The rate will increase from one-half to two-thirds, and will also apply to all capital gains realized by corporations and trusts. This is expected to impact approximately 12 per cent of Canada's corporations and Canadians with an average income of $1.42 million.

This tax change will apply to capital gains realized on, or after June 25, 2024.

Let's fucking go.

I would love a lifetime limit on the capital gains exemption on property, but this is a start.