pan to tax preparation companies taking turns sucking off Uncle Sam

My son made a mistake on his state taxes and his return was rejected. The letter he got back basically said "we couldn't verify your reported property taxes, so you can resubmit a correction or do nothing and accept our version of your taxes" (where he gets back about $200 less because of a typo.)

So, like, yeah. They're just comparing your notes to theirs, with the default benefiting the state.

Seems like the property taxes would be the easiest thing in the world for them to verify. Unless they've been lying to themselves.

There's a lot. Every tax form you get is submitted to the government as well. W2,1095 a, 1099, property taxes etc. For most people, the government could just send a letter saying: we have all the documents. Do you want to itemize or take a standard deduction? Do you have anything else to report? Cool. The people that would still have complicated taxes would be the self employed.

Yes, it would be helpful if people didn't have to chase down a bunch of forms that were submitted to the IRS already. But for instance in our family there's a lot of medical expenses, well over the minimum for us to deduct them, so we'd still want to do that.

Yeah itemized deductions would still need to be offered, but for many people the work would be minimal since it usually makes sense to select the standard deduction. That's horrible that you even have to pay that much for medical expenses but that's a whole other conversation lol.

I believe they had a typo entering their PIN. The property number is like 15 digits long with multiple hyphens. It was fine last year, but this year they got "wE cAn'T vErIfY yOuR pRoPeRtY tAxeS" .🙄

They don't actually know. If they think something looks suspicious, they do an audit, and then they know.

The vast majority of people's taxes fillings are taken on good faith.

Mind you, if you routinely fudge your taxes, they will eventually notice something strange, or hit you with a randomized audit. Then, whoops, we found something! Better take a closer look at all your past filings too....

They don’t actually know the final amount, but they do have an independent expectation for certain items.

If your job withholds income tax then it is paid quarterly to the government, so they know how much you made and how much taxes you should be paying.

If you win a large sum of money in the stock market or gambling at a casino then the broker or management company reports a tax bill to the IRS. The same happens for large early withdrawals of retirement funds.

They also know information based on previous returns, like how many kids you have or if you own a home.

They may not know it down to the dollar amount you’ll be paying because of the complexity of the US tax code and the deductions you’ll claim. For example, the government has no record of you purchasing a $600 electric car charger but you can claim that on your taxes to reduce your tax liability. That being said, if you under-report the amount you made at your job they will almost surely audit you if the number reported by your employer doesn’t match the number you provide.

In many countries, the government does have a record of you purchasing that electric car charger as long as you ask the seller to include your tax number in the receipt - which you need to do if you want to file it - and it all comes automatically pre-filled in my tax deductions. Its become really easy to do taxes, it's literally 3 clicks for most people.

"Listen bub, I'm just telling you what Intuit and H&R block pays me to tell you. So yeah, I both know and don't know what you owe. Let's call it Schrodinger's taxes and call it a day."

You don't know what we know about what you owe.

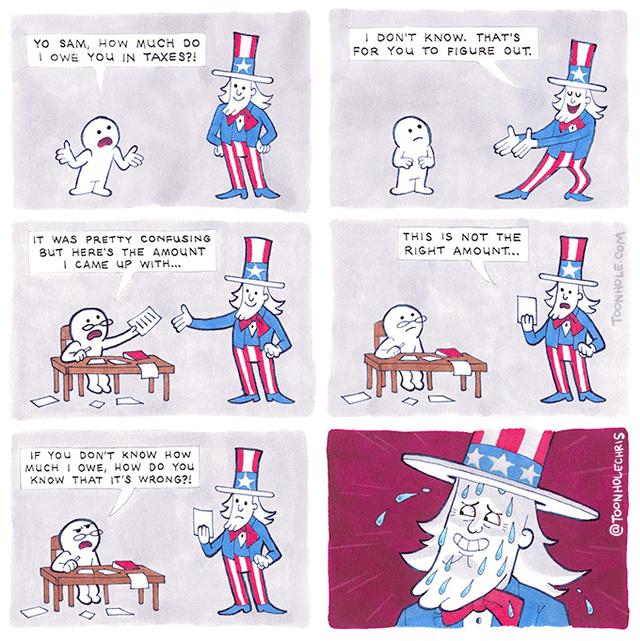

The answer of course is that the IRS doesn't know how much you owe, and it isn't feasible for them for figure out exact numbers for everyone with the tax code as complicated as it is. So, they audit a fraction of Americans every year to keep everyone honest. It's a bad system that taxes are so complicated but it's not a conspiracy.

It absolutely is a conspiracy though:

Except the federal government literally this year started instituting a free, public filling service to get around TurboTax. And they fought it tooth and nail.

There is a conspiracy, but it's not a federal government conspiracy. It's just a bad system that certain companies conspired to take advantage of.

I mean, the tax system is so bad because tax preparers like Intuit bribe politicians to keep it that way.

It is engineered the way that it is to provide loopholes for rich people.

God, I would hate to have to work out my taxes every year laughs in British

Hey, some of us do have to do taxes, but you pretty much follow a questionnaire on the gov.uk website then fill out some numbers from paperwork you'll already have (P60, payslips, etc). I had to whip out the calculator once to add up 12 numbers for my student loan.

Could probably do it in under an hour if you're not doing anything unusual.

The American system sounds very much not that.

For many Americans it’s actually pretty simple as long as they’re working with a standard W-2 (form you get from your employer with the year’s wages and taxes and stuff filled out). Many tax prep services will even import these numbers automatically and all you have to do is click through the questions and optional things like if you want to donate your returns to anything or pay estimated taxes for the next year - mostly stuff that most people aren’t concerned with anyway.

Taxes here start getting complicated when you are an independent contractor (you’re responsible for holding out taxes from your income since you don’t have an employer to do it for you) and/or have non-standard sources of income like stocks, shares, real estate holdings, etc. which the IRS may or may not have information on, thus why you need to provide the info.

Most of what has made calculating taxes and paying/getting returns a pain in the ass is tax prep companies like TurboTax lobbying to make and keep the tax filing process a confusing one, with the goal of steering you into paying for the non-free filing options.

I was shocked how easy it was to do my taxes when I was poor (back before the online services even). Just went to the library and spent half an hour filling out a 1040EZ form and dropping it in a mailbox.

It's harder now that I actually have contributions to retirement, back when I owned a house, make considerably more, have two kids and a wife that's going to school, etc. But still took me less than an hour.

And I would argue that if it takes you more than an hour to do taxes, you both should and can afford someone to do taxes for you.

You guys have to fill in numbers? The Australian Tax Office pre-fills your tax return with the data they get from your bank and employer, so most people can do it in 5 minutes by clicking next a bunch of times.

Its a nice break from figuring out if the amount my medical providers charged me lines up with the estimation of benefits provided by my medical insurance company and trying to get a denied claim paid.

I know what you mean. Laughs in Dutch

works as well with just the last two panels

Wow, yeah -- way punchier

because they won't tell you about the loop holes and exceptions you could be taking advantage of.

yep. They won't tell us if we payed them too much, they'll only tell us if we didn't pay them enough 😡

This year I think the IRS is rolling our free preparation (federal, some states offer it to I think).

Go check it out.

But yeah this could all be automated. Just another cigarette in your eye for daring to exist in the conservative fascist multiverse.

I looked into this. I didn't qualify due to having an HSA.

Yeah this year it seems there's a lot of restrictions. I'm hoping next year it will be accessible to more people

I hate fucking taxes. Just stayed on a call with Fidelity because I overpaid my 401k by a few dollars and they don't know how to set a reimbursement. Now I'm on a call with Anthem because they don't know why I never got my 1099-SA. Fuck. I really fucking hate taxes.

He only knows because your employer ratted you out

Your employer doesn't know all your sources of income if you have independent stuff going on.

I enter in my w4 and take the standard deduction. Takes me 5 minutes.

Haven't owed since I had a retail job that reset my withholding when I got promoted to make it look like I got a bigger raise.

Do you not earn interest on any accounts? No loans on which you pay interest? Are you a student?

Like I said: standard deduction. Those numbers never come close to make itemized deductions worth the time and effort.

Interest is income, so your W-2 won't be enough to account for that. You'll also need to go to any banks, taxable brokerage accounts, etc, because that money will impact your taxable income. Still not a ton of work, but it's still more than just W-2 + standard deduction.

Most people aren't going to have anywhere near enough taxable investment income for that to matter.

I think I got about $.87 in interest payments from bank accounts in the past year. I don't think that's going to make a huge difference in taxable income.

You need a better bank account then.

Let's say you have $10k in cash (typical emergency fund) and get 4% on it (relatively competitiv; e.g. Ally gives 4.25%), that's $400 in interest (not including compounding), which is a reportable amount of income. If you're doing something clever or have a bit more cash for some reason (e.g. saving for a house), you could easily get into more interesting amounts of money.

$10k in cash (typical emergency fund)

There's your mistake right there, thinking people have even $10k to serve as a spare emergency fund.

I don't even have a thousand spare right now for an emergency.

Funny

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.