view the rest of the comments

Mildly Infuriating

Home to all things "Mildly Infuriating" Not infuriating, not enraging. Mildly Infuriating. All posts should reflect that.

I want my day mildly ruined, not completely ruined. Please remember to refrain from reposting old content. If you post a post from reddit it is good practice to include a link and credit the OP. I'm not about stealing content!

It's just good to get something in this website for casual viewing whilst refreshing original content is added overtime.

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means: -No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

7. Content should match the theme of this community.

-Content should be Mildly infuriating.

-The Community !actuallyinfuriating has been born so that's where you should post the big stuff.

...

8. Reposting of Reddit content is permitted, try to credit the OC.

-Please consider crediting the OC when reposting content. A name of the user or a link to the original post is sufficient.

...

...

Also check out:

Partnered Communities:

Reach out to LillianVS for inclusion on the sidebar.

All communities included on the sidebar are to be made in compliance with the instance rules.

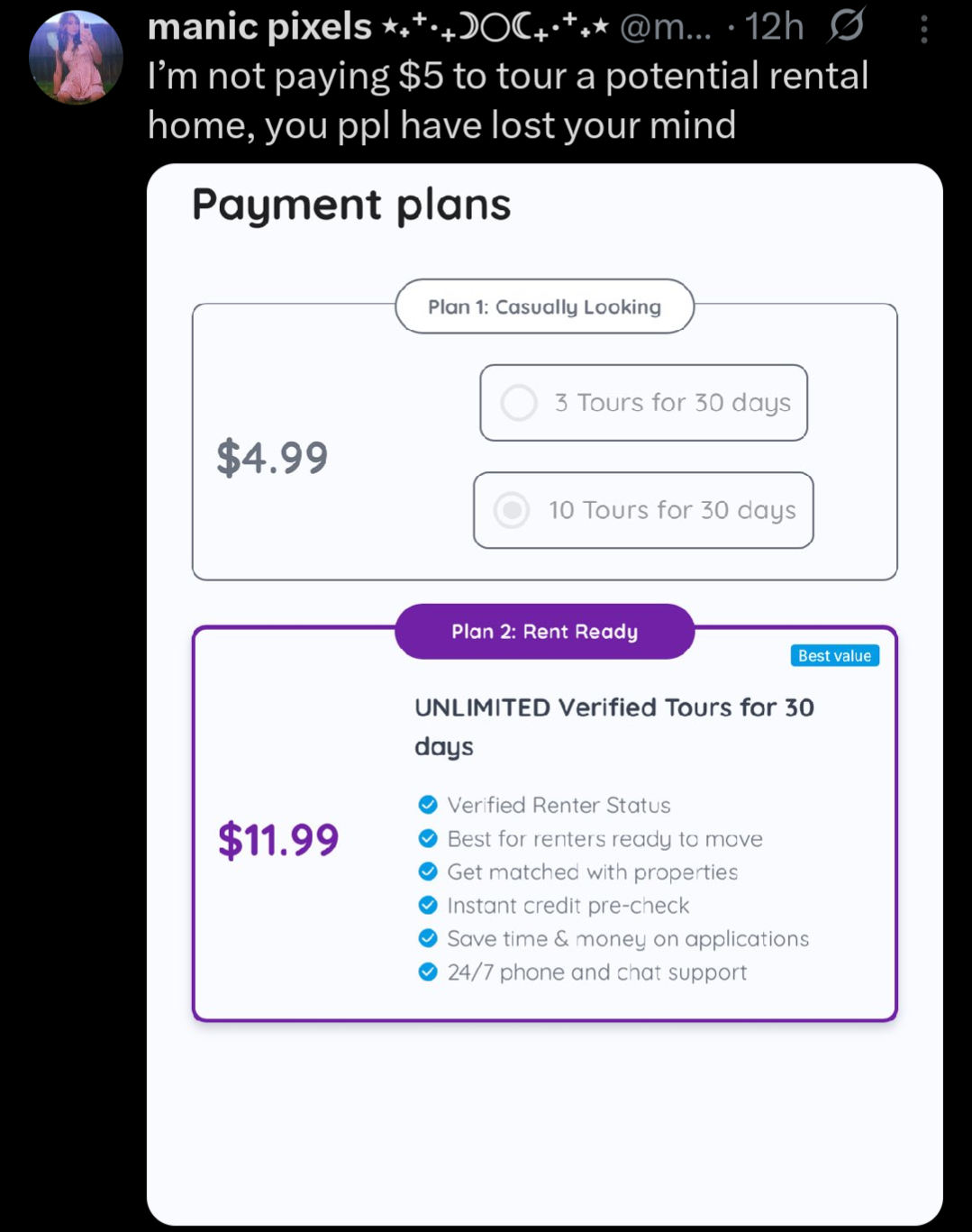

Hah what are you going to do, buy a house instead? We're all fucked once this is the norm.

I don't know if this applies in the US but multiple people can take out a mortgage against the same property. If you have 3/4 trustworthy friends then you can pool your money to buy a place. It's complicated but better to invest your money in your own property than to line the pockets of cunt landlords and letting agents.

That would require people to have three to four close friends that could tolerate their presence. That's an exceedingly rare thing in the US as we're mostly all intolerable cunts.

Also, it would require every friend to have savings to put down a down payment and also credit good enough to actually qualify. That's on top of finding 3 or 4 friends you're willing to live with.

Do you think that 20% of $350k is about $20,000? I feel like I'm missing something important here .

Maybe first-time home buyer programs? But those are like 3% typically so it wouldn't get you there and that's before including closing costs, moving costs, and possible repairs.

350,000 x 0.20= 70,000

70,000 / 4 = 17,500

17,500 - 5000 = 12,500

Each person would need 17,500 for a 20% down payment, 12,500 more than the 5000 quote.

Not to mention 3 or 4 ppl that can and will reliably make mortgage payments for 15 or more likely 30 years. Once someone drops out because of life events then they'll want to be bought out by the next person which introduces a whole bunch of headaches. Having watched this exact thing play out, this will most likely turn into a bitter nightmare of endless paperwork and some ruined relationships.

And bam, new laws come out that makes it illegal for more than X people who aren't related to each other to share a home.

This is actually a thing in many places so people can't do what you just described, isn't American Freedumb so beautiful

This is called tenency in common. I'm unaware of it being illegal in any states and a cursory search brought up nothing. Do you have any leads you can share?

I see it now. I'm looking at tenancy in common based on the original comment, you (and presumably the previous commenter) are talking about unrelated occupancy provisions. One is about co-owning, the other is about cohabitating.

This is exactly why people DO use exact language, despite your utterly bizarre insistence otherwise - because those that don't confuse the rest of us with their shitty communication.

Yours has to be the most American comment I've seen this morning. BTW, you're literally using literally incorrectly.

Co-ownership is kind of a horrible idea overall. What happens when one of the 4 people wants to use the property as collateral for a loan?

Not to mention that this promotes increase in property costs without fixing the issue. If the norm is to continue pooling money between individuals then real estate can continue to raise prices. Then you just need 6 friends 10 friends 14 friends etc. we need a market crash and we need corporate residential ownership to be heavily regulated.

Nothing major honestly. If they default, they would lose their stake in the claim. Since they don’t own the entire house, the bank couldn’t foreclose but they could assume ownership of their portion of the loan. The bank would view it more like a financial instrument rather than a real property.

Millions of tiny houses isn't the worst idea.

From experience, basically no banks take collateral on co-owned homes. You probably won’t run into problems like that specifically. You can also easily structure an agreement with a lawyer. In many states you have to have an attorney to buy a home anyway (CT, MA, GA, DE, KY, LA, MD, MI, NH, ND, OK, RI, VT, WV, WO). We used ours to write and tack on the equivalent of an HOA arrangement you’d see in a condominium for our shared rooms.

I do find it amusing we have redditors arguing landlords should be illegal and others arguing co-ownership is a bad idea. Yes, let’s build millions of single room houses for everyone who is single that span the entire continent.

Create a trust instead.

Contact an attorney to draft a trust where you all share equity at an amount you all agree to. The terms of the trust should indicate how someone sells their interest and what happens upon default, etc.

The trust buys the property and owns it. Ownership is managed through the trust.

The hardest part is qualifying for a loan. You're essentially operating as a business and most home loans are designed for people and couples.

I’m not 100% certain what our attorney did to structure our trust but we were able to do this without the trust having to buy the house itself and still could utilize a CRA loan program loan from a traditional bank and avoid PMI at a lower down payment.

I knew people who did this after college with an apartment building. Not sure that's feasible these days but that seems like it would be much easier to transition out of than a roommate situation.

I haven't really had any delusions that I'll ever be able to afford to buy a house anyway, but I'm kind of at the point where I don't even want to.