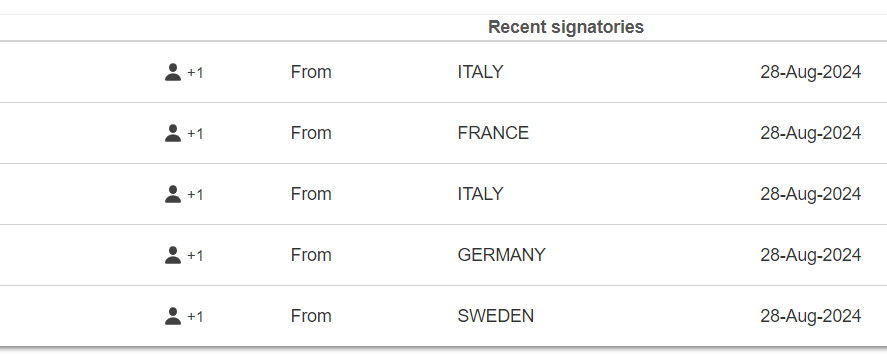

Ideally we should massively share it in communities of the top 5 countries where the threshold wasn't reach.

So Denmark, Belgium, Italy, Netherlands and Slovenia.

But it's too late it end in 1.5 weeks.

Ideally we should massively share it in communities of the top 5 countries where the threshold wasn't reach.

So Denmark, Belgium, Italy, Netherlands and Slovenia.

But it's too late it end in 1.5 weeks.

Je viens de poster sur !belgique@jlai.lu, on verra si ça a un effet

Tu peux voir le feed temps réel sur le site.

Lol malta being last is so fitting.

If only the Italian man who went there taught them about class inequality

The petition also needs to go over 1million signatures. So French and Germans signatures help as well.

Already signed!

signed

Edit/commentary: I understand that this proposal is less than ideal, because "tax the rich" is not going to solve the problem. We need a reform of our basic principles of economy. But it's a sign that something must be done against the inequality.

Hadn't heard of this yet. I signed it.

Only people living in Malta are billionaires

Slovenia ahead of Croatia! Let's goooo, all I care about!

Europeans don't care. they just want to complain.

P.S signed

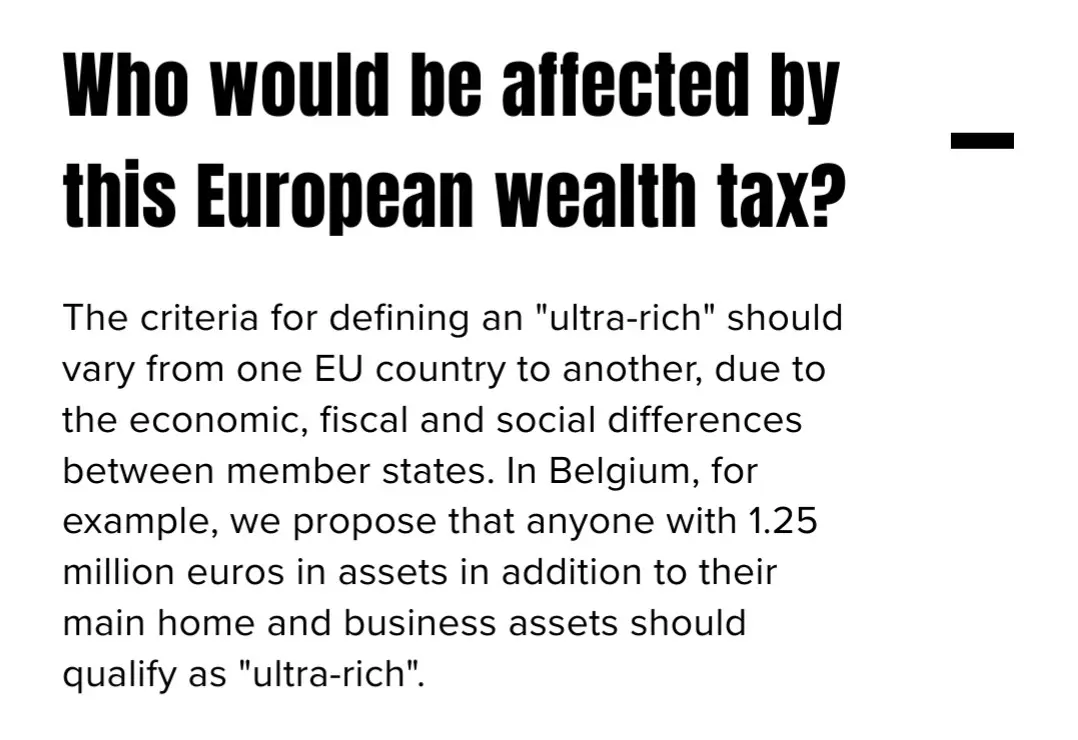

i believe they might not know that this is important and will affect folks who earn around 1000€ passively from interests... per day ^^

+1 from Belgium!

I'm not against this initiative per se. But this is just another tax on middle class people and doesn't tackle the real wealth being hidden in multinationals that don't pay any tax and hold governments hostage by threat of moving their employment away. They are the problem. They pollute like no other because no one is ever held accountable.

Interesting that every country that was in the Soviet bloc doesn’t want a bar of this

From https://www.tax-the-rich.eu/home#info

What a bad initiative. This would basically guarantee that people in Europe can't ever retire on a modest income.

1.25 million euros per person on top of your main home doesn't allow you to retire?

It's probably not so much you can't retire, but you can't retire with an income that you'll be comfortable on.

A brief look suggests the average pre-tax wage in Belgium is around €3800, or about €45000 per year. Assuming you already own your home, or continue to pay mortgage payments at the same rate as before retirement, your pension needs to roughly match your income to not have a drop in living standards. A €1250000 pension pot will buy an annuity that pays a bit more than that, probably around €55000 a year, but assuming you amassed that in your pension pot you would probably have been on a higher than average salary, so it's going to be close, and an annuity at that level wont increase with inflation, so your buying power drops over time, just when you're more likely to need a care home or nursing support.

This just qualifies as ultra-rich - which is not wrong, imho. I don't know the exact conditions for Belgium but in Germany the taxes would start to show effect at 4,6 million with 2%. If you think about it assets in this magnitude could easily lead to 1000€ daily passive income. Those 2% wont hurt.

But it doesn’t include the home or business assets. So you could have one guy with €1.25 million in stocks who lives off a modest income from dividends and sleeps in an RV and he would be classified as ultra rich.

Another guy could live in a €2 million mansion and be the owner of a €100 million business (but have no other investments) and be classified as NOT ultra rich. See the problem?

Yeah, the problem is you're shooting down a great initiative with an edge cases that affects maybe a couple dozen RV sleeping millionaires. Maybe he should participate and contribute to society!

Edge cases are what these guys used to get their fortunes in the first place. The more common term for these is tax loopholes! Everyone knows that big corporations like Apple use them (“Double Irish” being the most infamous) but individuals use them all the time.

Anyway, the point I’m making is that I really don’t care about the RV sleeping millionaire, I care about taxing the 200 millionaire business owner I mentioned who would currently be exempt. Because of the loophole, you can bet that all of the “ultra-rich” are going to restructure their investments into a single business they own so that they can completely exempt themselves from the tax.

Yeah, start with this law then close loopholes. It's like you're climbing a cliff, you don't leap straight to the top you get handholds where you can find them and make your way up.

A laid back community for good news, pictures and general discussions among people living in Europe.

Topics that should not be discussed here:

Other casual communities:

Language communities

Cities

Countries