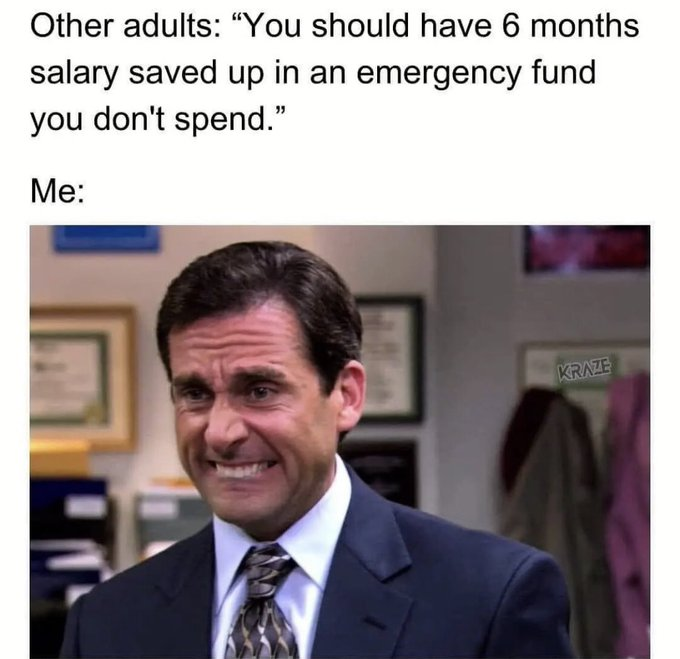

This hit a lot harder than I feel comfortable with.

If you're under 30, full-time job, no looming debts, no kids, then the 6 months can really be 3 months or around $10,000. If you have a partner, you are even more secure. Remember this is a figure derived from very conservative financial commentators who assume you have a linear college and job progression (which is rarely the case). Even a 1 month savings buffer will save you for 90% of the unexpected expenses.

If you're in your late 50s, finding a new job will be tough, especially if you are laid off during a recession. In that case a generous buffer beyond 6 months would be good.

Either way, having savings is a good thing. Yes you will miss out on those "epic Bitcoin gains", but once you have made an emergency savings buffer, then you can really knuckle down on contributions to retirement.

You should've told me earlier when I could've. Now I learned the hard way.

I am 26 and I have like 14 salaries saved up already but they are barely 10k dollars because of my stupid third world country currency :') am I doing well or should I just give up and wait for my next reincarnation? :')

I don't have anything remotely close to 6 months savings in the bank. It doesn't make economic sense for me to do so. I'm far better off talking any would-be savings and put it towards all this debt I'm still carrying from my college days.

You will never make more interest on an investment than you will get charged interest for the same amount as a loan. Ever. It does not happen. So for me to sit on money that could go towards paying down debts, I'm just needlessly paying more in interest than I would be otherwise.

My current plan is to pay down or pay off all by debts (ultimately paying them off but if they're close then ok); then consolidate all of my remaining debt into a line of credit, and close out all of my other debt accounts. When that's paid, it will hopefully be enough that I can put that available credit towards any spontaneous costs, and if no such costs occur, save as much as I can so I won't need the line of credit if I have incidentals. Hopefully saving up to 6 months or more, plus investing into a retirement fund.

The retirement fund is an afterthought because at this point in my life I expect that I will be financially incapable of retiring. I'll just work until either I go crazy (dementia or similar), or I simply die at my job. I'll just work until I'm dead.

I've been so financially fucked by all the once-in-a-(insert large amount of time here) events that just coincidentally all happened during my life so far that this is what I'm expecting going forward. Record inflation, stagnant wages, everything as-a-service basically robbing you monthly for something you should have bought and long since paid off, but instead you're paying for in perpetuity for no good reason....

Everything has turned into a monthly charge. It's terrible, and you think "oh, it's only $20 a month". Yeah, that's $240/yr. For something that probably doesn't make you any money and probably doesn't help you with your employment or any earnings you may bring in... It's just a stupid tax. We're stupid.

It's generally 3 - 6 months of living expenses depending on your situation (generally on the low side unless layoffs are likely) which is very different than salary of an equivalent time frame

Start running a zero balance with a set amount. So if you ste your zero at $100. If you have $200 you only have 100. Raise this over time until you have enough

In my life it was either I could not save anything or I could save a lot, the expenses are basically the same but the income changed. Once the income was higher than the expenses the saving happened automatically and are steadily growing over time.

I’ve got 6 minutes of salary saved, this is adulting!

I found a much easier method that was told to me is, (dont make a purchase unless you can afford to buy it twice)

I cant afford to fill up two tanks of gas, but i still gotta go to work. The economy is absolutely fucked no matter what economists say about avoiding a recession.

Memes

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), !politicalmemes@lemmy.ca can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. !politicalmemes@lemmy.ca

- Merkitse K18-sisältö tarpeen mukaan