Just in case anyone is curious about how it works...

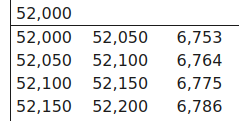

Your entire income isn't taxed at the same rate. Each chunk of your income is taxed differently. The first 11k is taxed at 10%, the next 35k is taxed at 12%, the next 50k is taxed at 22%, and it continues on at different intervals after that. This person believed that going from 44k to 45k would then change their tax bracket and their gross income would be taxed at 22%, thus reducing their net income. This is false. Only the amount over the threshold gets taxed at the higher rate. Always take a raise if it benefits you.